Home Values on Zillow Explained

Are you wondering whether Zillow house values are accurate?

More tools are available online than ever for the average person interested in buying or selling a home. The internet provides numerous resources for everything related to real estate – locating properties, viewing, listing, advice on buying and selling, and even pricing calculators. Zillow is one of the more popular real estate websites offering many tools.

Unfortunately, while these tools can undoubtedly prove handy, there are times when using them can give you unreliable information. One such tool that has proved to be unpredictable repeatedly is a Zillow home value or Zillow Zestimate, as the company likes to call it.

What is a Zillow Zestimate?

A Zillow Zestimate is a trademarked term used by Zillow for calculating home values on Zillow.

Zillow’s Zestimate provides a home’s value for any property in the United States. Unfortunately, Zestimate accuracy is all over the map, just like other online estimates.

When buying or selling a home, you should never rely on Zestimate on Zillow to make a value decision. Whether you buy a house or sell a house, you’ll want accurate information to make an informed decision. Looking at a Zestimate on Zillow can be fun, but it shouldn’t be used to make vital real estate decisions. It is essential to rely on professionals, not online home value estimators.

There isn’t a home value estimator that can consistently be relied upon for delivering an accurate fair market home value.

By the time you’re done reading, you’ll have an in-depth understanding of why home values home value estimation sites are not be trusted

What Are Other Home Value Estimators (HVEs)?

The Zillow Zestimate is not the only home value estimator. You can get home value estimates from Realtor.com, Redfin.com, Trulia.com. Opendoor.com and others. Like Zillow Zestimates, these sites also can be way off in estimating home values. Forsalebyowner.com provides estimates for those who are selling without a real estate agent. None of these home value estimators should be trusted to deliver accurate house values.

What is The Best Home Value Estimator?

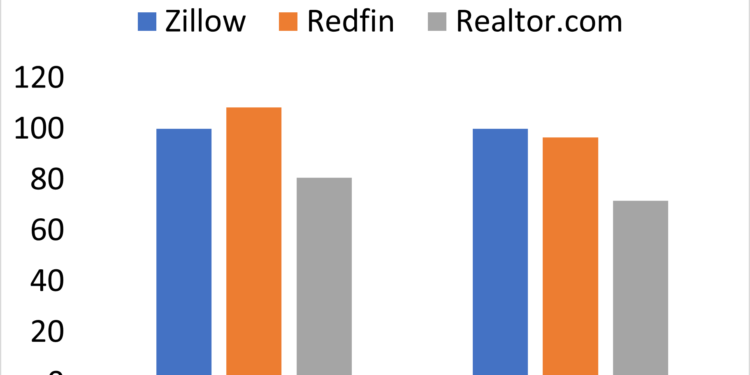

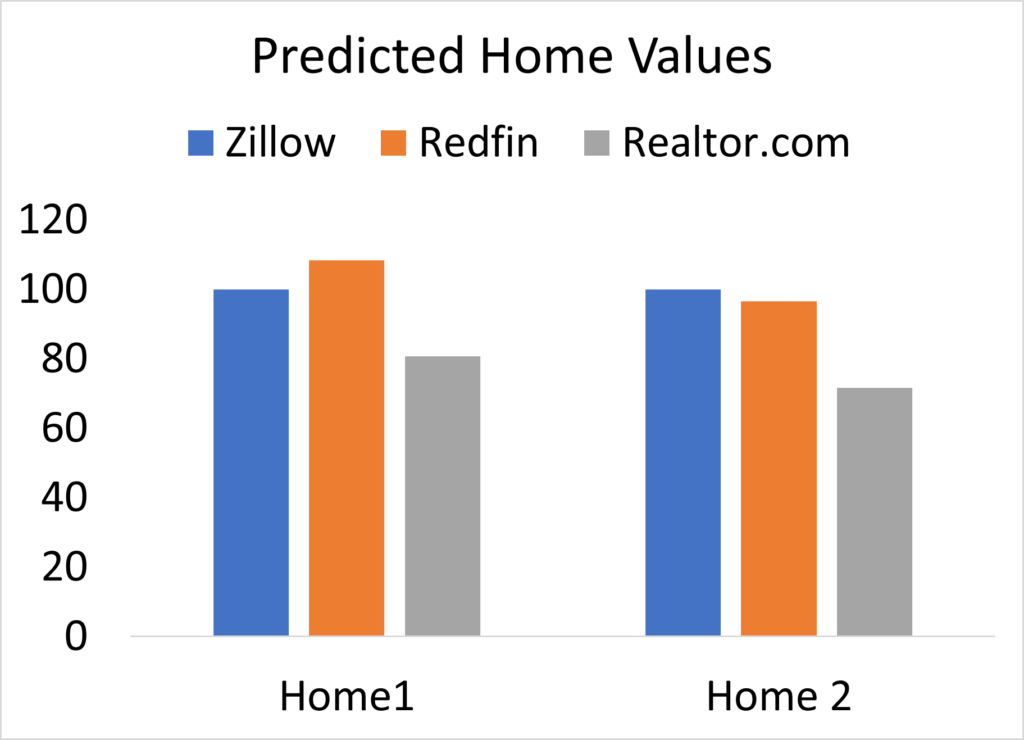

None. For any serious real estate decision making none of them should be considered the best because they are all inaccurate. Just look at the chart below for values of two homes in Bay area predicted by three different websites Zillow, Redfin.com, and Realtor.com.

A free home value estimator should be used for laughs, not for making critical pricing decisions.

The Problem With Online Home Value Estimates like Zillow

Where once the world of comparable sales and real estate values was understood only by real estate agents, now everyday buyers and sellers can learn tons of helpful information about area properties, including their own. Websites like Zillow have great potential to empower buyers and sellers. They no longer have to go to a real estate agent for every little piece of knowledge.

he problem is that the estimates – or “Zestimates,” as Zillow calls them – are not always accurate. They can be wildly off, leaving the buyer or seller worse off than before they looked at them. Zillow may do its best to give you an accurate price of what a home is worth. In the end, though, it is only an automated system that cannot think for itself. It cannot account for variations in any number of things – changes that substantially alter the price from any “average.”

Could the estimations be better programmed to account for this stuff? Definitely, but we are not dealing with the ideal Zillow; we are dealing with it as it is now. When trying to buy or sell, you cannot afford to be off by tens of thousands of dollars in your pricing or bidding.

So when someone asks a Realtor, “are Zillow home value estimates accurate,” you will probably see a look like the one in the picture above.

From my experience, looking at Zillow home values in the area of Bay Area, where I am located, they are typically off anywhere from $20,000 to $50,000 of the actual market value. Probably better than some markets but worse than others.

How Zillow Estimates Value

You’re probably wondering how Zillow calculates home values.

Zillow uses a proprietary formula to determine the value of a property based on information the website has obtained from public records and information entered by users. For example, they will use the number of bedrooms, baths, the square feet of living area, and other property data points to determine property values.

The site knows what the home sold for the last time it was purchased, and it knows this same information for other homes in the surrounding area. Using this, along with data entered in by homeowners and user-submitted data – things like features of their particular home – Zillow comes up with a price that a home is worth.

Zillow’s proprietary algorithms take all available data and use it in the Zillow home value estimator to arrive at their market zestimates.

Unfortunately, Zillow’s algorithm cannot consider all the unique characteristics of individual properties that dramatically impact their value.

Assessed Value is a Significant Piece of The Zillow Zestimate

From what many have gathered, one value factor at the top of Zillow’s formula is using a property’s assessed value from tax records.

Unfortunately, rarely does the assessed home value correlate with market value. They are two completely different things. Towns use assessed values to collect taxes and, in many cases, trail the actual market value of a home.

Using this piece of information will throw off Zillow’s home values right off the bat. In my experience, I have seen homes sell for over $100,000 more than the assessed value. I have also seen them sell for that much under the value.

Intelligent real estate agents never look at the assessed value when determining market value. If only life were that easy. It would make our jobs as agents so much easier.

The assessed value should be used for forming tax assessments, and that’s it.

Why Zillow Estimates Fail So Often

On the surface, Zillow’s method seems like it would give a pretty decent ballpark figure for the value of a home. And sometimes, it succeeds. More often, though, the Zillow home value is off significantly – sometimes by 40% or more.

A property’s most recent selling price is undoubtedly helpful information and is likely the most accessible concrete data that Zillow can obtain. What a home is sold for is information that buyers and sellers should know about properties. However, it does not indicate what a home is worth now. The market is changing minute to minute and a sale price that is years, if not decades old, is no way to estimate the current value of a home.

The recent sale prices of nearby homes are also helpful when buying or selling. Known as comparable sales, they are a significant factor in how a local real estate agent will price a home. The problem is these comparable sales need to be considered for what they are – not as indisputable numbers. Comparable sales can only be viewed as an apples-to-apples scenario in particular situations.

A Zillow Home Value is More Accurate With Cookie-Cutter Homes

If your home is very similar to all the other homes in the neighborhood – such as in a newer housing development of moderately priced homes – and no one has had time to renovate the properties, comparable sales may be easier viewed as apples to apples.

But if you are in an area where the age, size, or features are varied, it quickly becomes an apple to oranges situation: both fruit, but very different kinds of fruit.

The way a Realtor determines real estate market value is off the charts, different than how Zillow’s website does it. Local real estate agents or even professional appraisers understand how one comparable sale relates to the next.

An excellent Realtor is seasoned in comparing drastically different homes in a single neighborhood to get an accurate price on a property. Zillow does not have this kind of ability. This is why it can be off so significantly at times.

Comparable properties are only one tool in measuring a home’s value, and Zillow is not as great at using this information as it should be.

The Accuracy of Zestimate is Off and Zillow Informs You

Zillow’s website does an excellent job of informing consumers that Zestimates may not be accurate on this web page. The problem, however, is that most people never see it. Maybe it would be a good idea for Realtors to share this webpage more.

Another reason the estimates are so off is that their evaluation method differs from that of a comparative market analysis (CMA) completed by a real estate agent or a home appraisal completed by a local certified appraiser. Geographically, the data Zillow uses is much broader than just your neighborhood or town. Zillow states that they often use all the county data to calculate property values. There may be no recent sales in the “neighborhood,” but even a few sales in the area allow them to extrapolate changes in the local housing market for a particular area. However, the data they gather does allow the models to incorporate the neighborhood patterns of recent sales.

Zillow states that the median error rate for all U.S. homes is 5 percent. It sounds impressive until you realize what that means. For all those non-math majors out there, the Zillow property value is within the purchase price only 50 percent of the time.

Frankly, that sucks! Can you imagine wanting to know the value of your home and the actual sale sales price was off by more than 5% over half the time? If you got a professional appraisal of the home, you would be greatly disappointed if they were off by that much.

If real estate professionals also gave you inaccurate information to make an informed decision, you would not be pleased. Who would?

Zillow also states that their media error rate for on-market homes is 1.9%, while their off-market homes come in at 7.5%. The correct listing price and corresponding final sales price are critical for buyers and sellers to make the best decisions.

When you sell your house, you want the estimated value to be accurate. Likewise, when buying a house, you want the subject property price range value to be close. Negotiating is tough if you’re relying on public data that is not accurate.

The bottom line is the margin of error is far too high to rely on at the end of the day. The real estate industry demands accurate information, and online tools are no way to get it.

The Zillow home value index may have improved since its inception, but it is still far from being a good thing to trust. The actual value of a home is best calculated by speaking with professionals.

Zillow Doesn’t Come in Your Homes

Potential buyers and sellers need to understand that Zillow does not enter properties. They have no idea what you have done to your home or in similar homes. They don’t know what, if anything, we do to our houses. You could drop $75,000 renovating your kitchen and baths tomorrow, and Zillow won’t know that.

How could you expect them to come up with an accurate estimate without this information?

Here are more things to ponder:

- Zillow doesn’t know that the town data card is wrong and you only have three bedrooms, not four.

- Zillow doesn’t know you have a $20,000 structural crack in your foundation that needs repair.

- Zillow does not know that your roof is on its last leg and needs replacement.

- Zillow does not know you have a significant easement running through your backyard that limits its use.

- Zillow doesn’t know you just added central air conditioning, a sprinkler system, a security system, and $10,000 worth of landscaping.

Is the picture starting to become more explicit about the accuracy of Zillow estimates? Zillow’s home values can be off by these things and others.

The Solution

If you want to know accurate home value then comparative market analysis (CMA) completed by a diligent agent is the way to go.

Home Value Estimators vs. CMAs: What’s the Difference?

There are a few differences between getting a home value estimate online vs. obtaining a CMA report from a real estate agent:

| HVEs | CMA | |

| Who creates it | Computer | Realtor |

| Timeframe | Few minutes | Few hours |

| Cost | Free | Usually free |

| Use | Ball parking home value | Setting list price |

- Home value estimators use computer algorithms to determine your home value, relying on public information from tax records and local sales data.

- Realtors create CMA reports using data from local MLSs and usually fact-check a property’s information with homeowners before completing the report.

- A realtor visits your home in person and can give you credit for any renovations or improvements you’ve completed.

The bottom-line

Ultimately, a home value estimator is useful for a quick ballpark home value. But it shouldn’t be relied on to make a major financial decision, like setting a listing price. Only a CMA prepared by an experienced Realtor should be used for all serious decision making, such as selling your home. Connect with me for a free, no-obligation CMA report and the most accurate home value estimate.