In January, I had written about market predictions from NAR about real estate market in 2023 and 2024. And as we move in to the year, it needs to be seen what the market does. At this time, many folks are worried that the real estate market may crash anytime soon. A large size pool of buyers is waiting on the sidelines to see if the market in 2023 offers opportunities to buy (possibly in the same way it did during 2007 crash). Lets, see if there is data that can shine more light to guide us.

Is Early Spring Surge in the Works?

All the new home communities that I visited in February reported increase in list prices. As per them, this is the result of nation’s homebuilders seeing increased demand. Homebuilder sentiment in January rose for the first time in 12 months, the National Association of Home Builders said. Builders reported increases in current sales, buyer traffic and sales expectations over the next six months. Lower mortgage rates are driving the new demand.

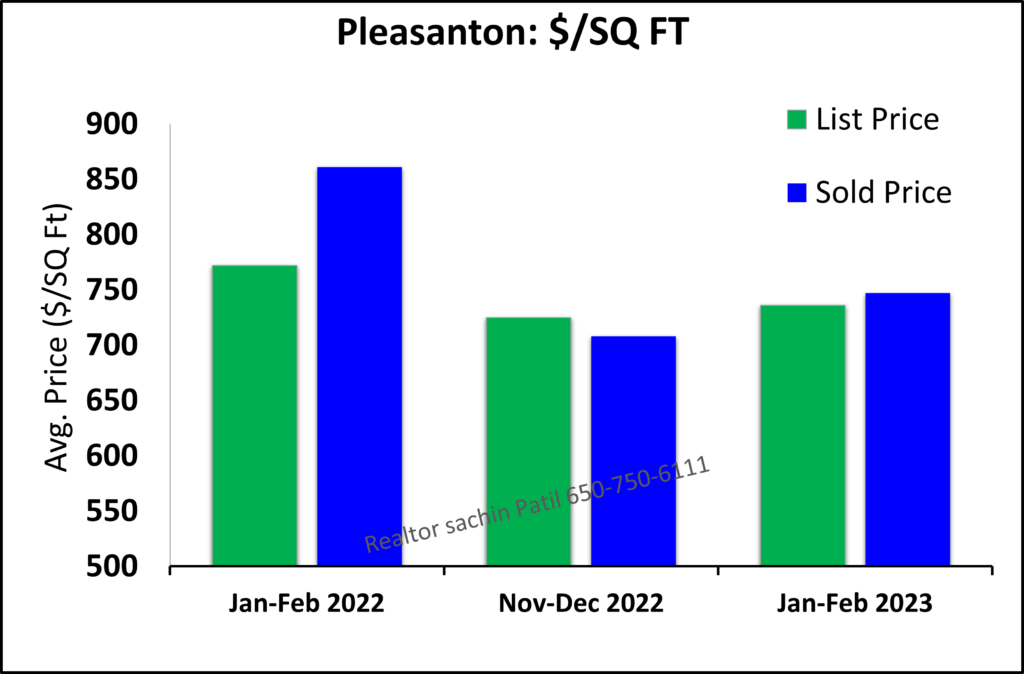

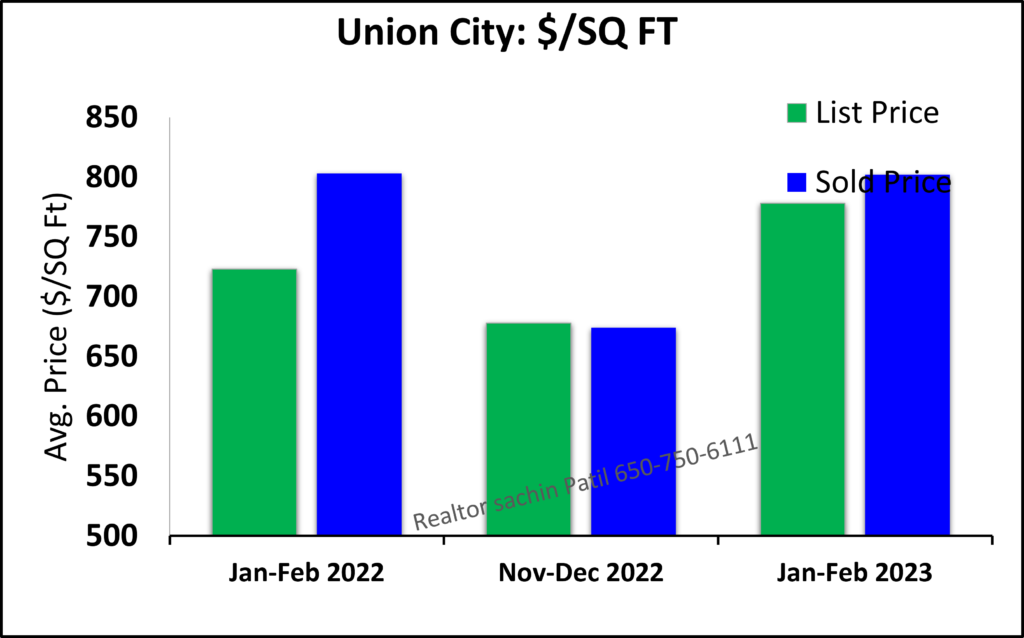

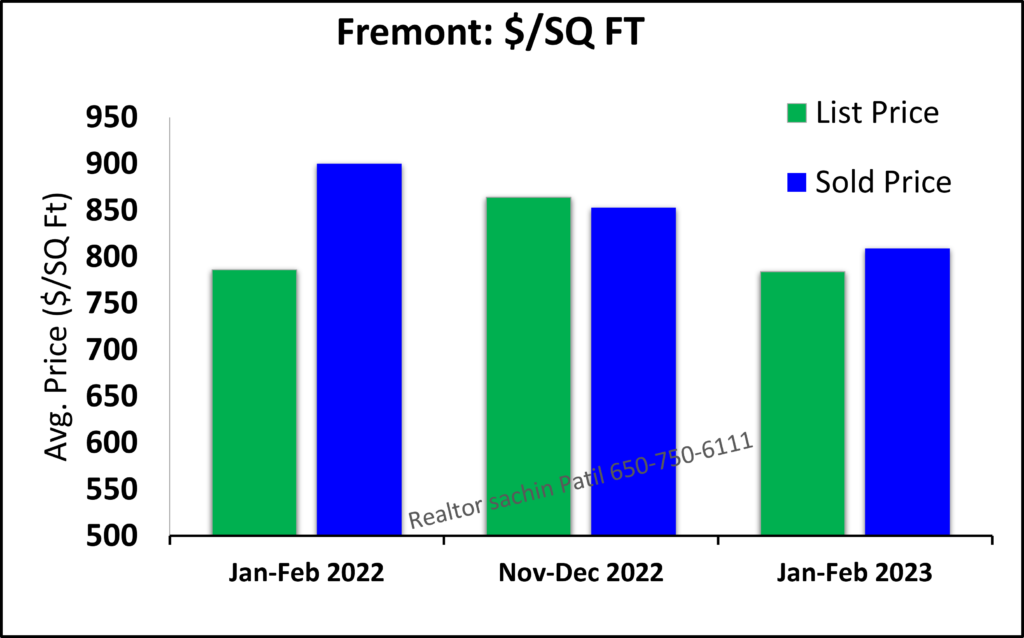

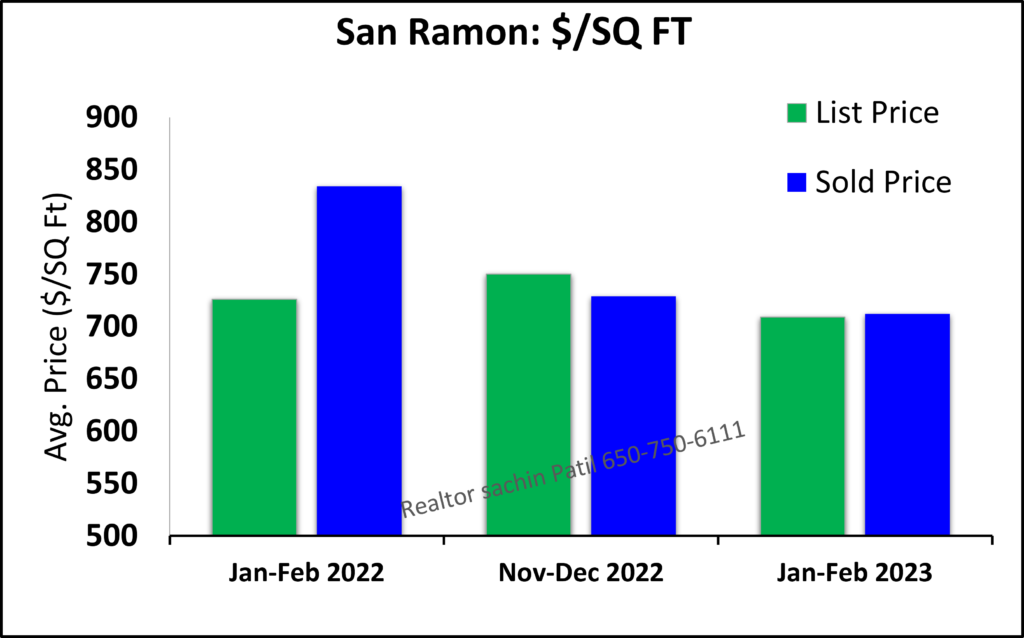

Home prices across Bay area started softening starting middle of the last year, and continued dropping in to the new year. Home prices appear to be improving now as sold prices for homes listed in January-February are higher than list prices. Figures 1 to 4 show list price and selling price comparison for the homes that listed in January and February, 2023 in 4 cities across Bay area.

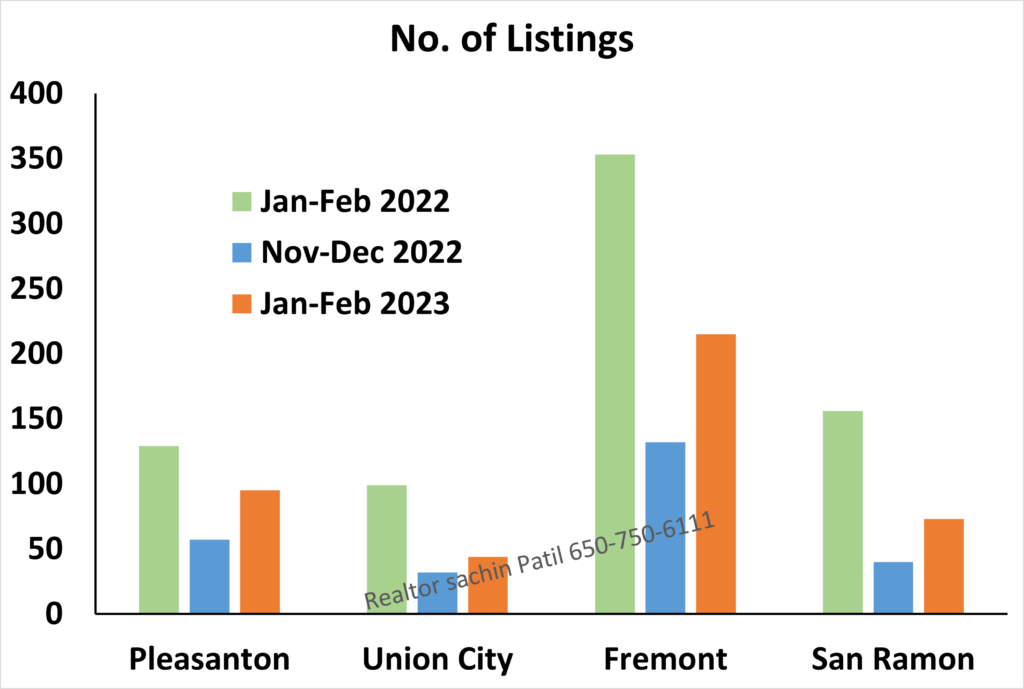

Understandably the inventories are still low but they are improving. Figure 5 shows the comparison of the current home inventories with inventories from same time last year when market was still rapidly rising as part of the COVID19 surge.

What About Foreclosures and Recent Layoffs?

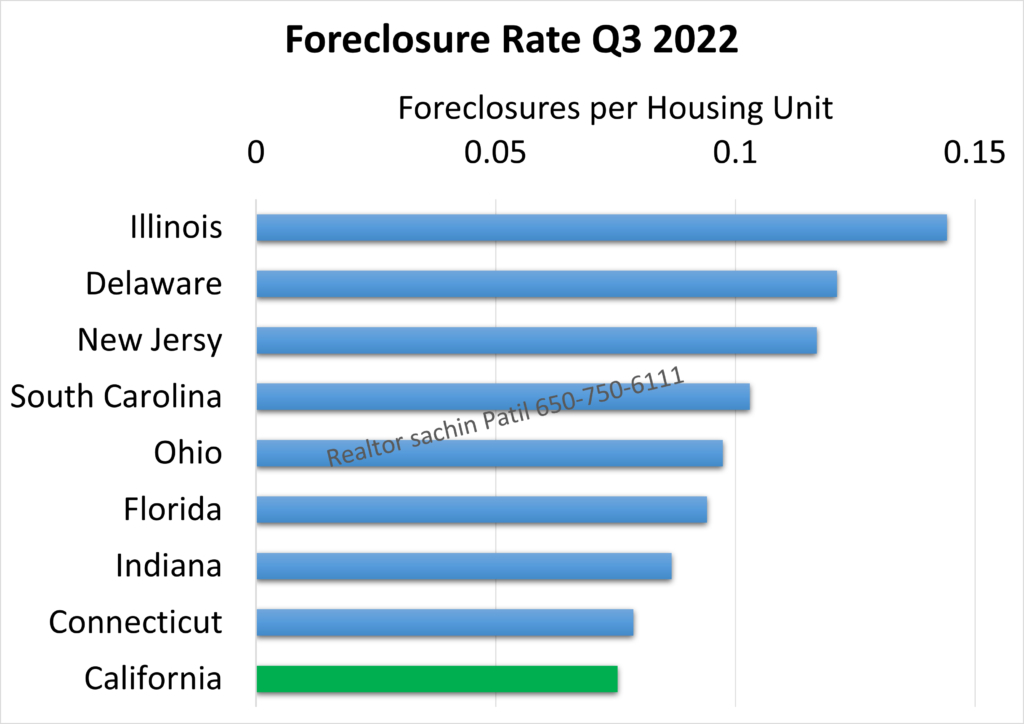

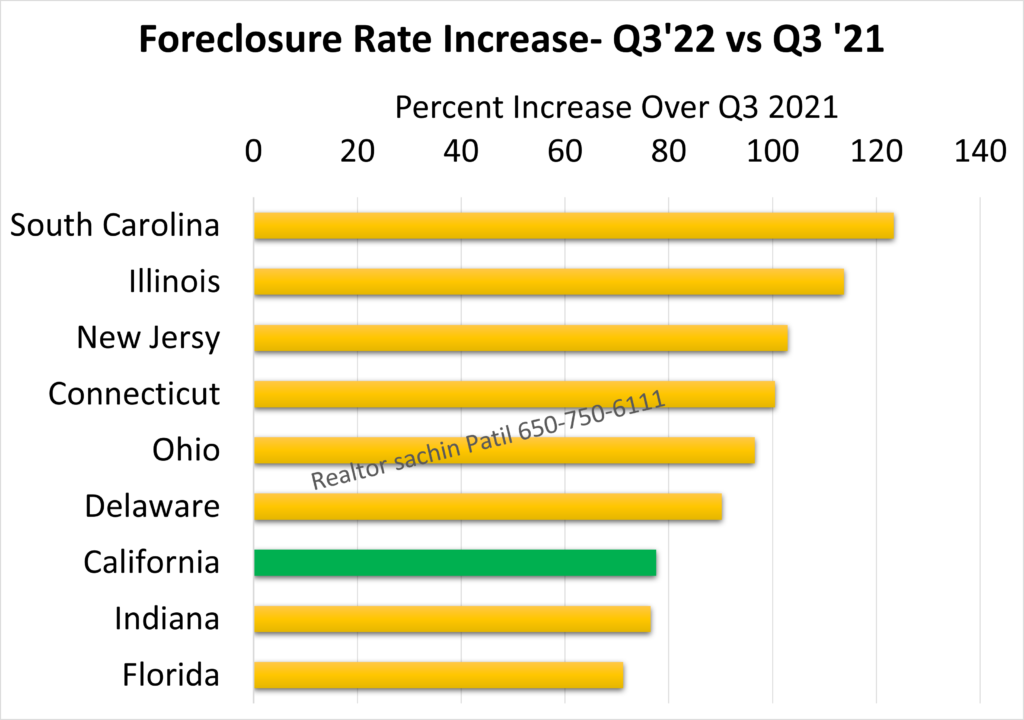

One of the key market health indicators people watch is the foreclosure activity. As I had discussed earlier, the foreclosure activity has been extremely low so far. Although, the foreclosures seem to have spiked recently. As of Q3 of 2022, California ranked 9th nationally for foreclosure rate as shown in Figure 6 and ranked slightly higher for increase in foreclosures from Q3 2021 (Figure 7). Even though the numbers are still small, these numbers need to be monitored closely moving forward.

Recent news about tech industry layoffs has resulted in increased fears for more foreclosures in Bay area. Some of the largest tech companies are in California but to put in perspective, they are not the largest California employers. In fact, the tech companies do not feature in the top 10 as shown in Figure 8. Whether the recent tech industry layoffs by themselves have significant impact real estate market or if they are part of a larger trend needs to be seen.

What About Mortgage Rates?

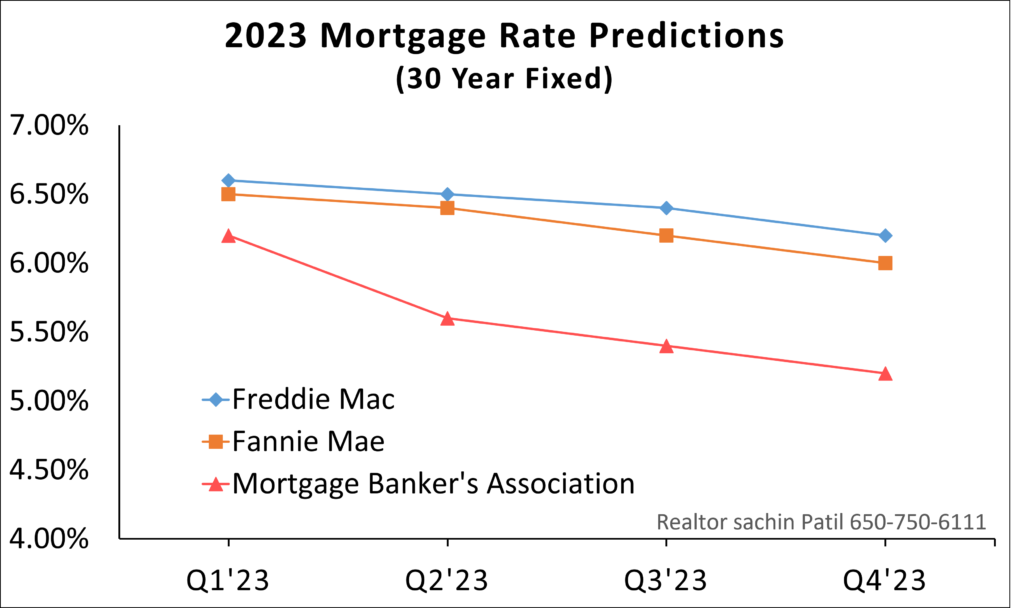

The mortgage rates are predicted to be lower in later part of 2023, as inflation recedes and the U.S. economy prepares for the possibility of a modest recession, according to some of the nation’s leading real estate economists. This comes after mortgage rates saw record-breaking annual gains in 2022. The lowering interest rates are expected to improve affordability which has been tightened by increasing rates and home prices.

The interest rate predictions from 3 different sources are summarized in Figure 9. The latest monthly Housing Forecast from Fannie Mae has the average 30-year fixed rate declining from 6.5% in the first quarter of 2023 to a flat 6% by the end of the year. Freddie Mac’s most recent Quarterly Forecast, released in October 2022, is pretty much in line with Fannie Mae’s predictions. The mortgage giant puts the 30-year mortgage rate between 6.6% and 6.2% throughout 2023, with an average annualized rate of 6.4%. The MBA’s (Mortgage Bankers Association) December 2022 Mortgage Finance Forecast puts the 30-year fixed mortgage rate at 6.2% in the first quarter of 2023, gradually falling as the year progresses.

Summary

Based on the recent Bay area market activity, it seems that market has changed from November-December last year and homes have started to sell well. The inventories improved but still are lower. It needs to be seen how the economy and job market does in coming months. For the near term the market appears to be moving and may possibly keep moving if the interest rates drop. For home buyers as well as sellers, second quarter onwards could prove to be a good time to get in the market.

Lets connect if you are looking to purchase a home or sell your current home or both.

Very impressive and useful analysis

Thank you Gautam! Its great and important to hear your feedback.